rhode island income tax nexus

86Nexus Generally 87Corporations Subject to Taxation Generally 88Combined Reporting Requirement for C-corporations and Combined Groups Factor-Based Nexus Approach for. Rhode Island for the State to have taxing authority.

Detailed Rhode Island state income tax rates and brackets are available on.

. 2022 Child Tax Rebate Program In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. 153 average effective rate. This amendment provides guidance regarding Nexus for Business.

Up to 25 cash back For purposes of comparison note that Rhode Island taxes personal income at marginal rates ranging from 375 to 599. 4 United States Public Law 86-272 codified at. 34 cents per gallon of regular gasoline and diesel.

A foreign corporation is subject to Rhode Island corporate income tax if it conducts business activity in Rhode Island and has income. Laws 7-12-59 Establishing Nexus In general terms nexus means that a business has sufficient connection or presence in RI for. 3 Rhode Islands corporate income tax is also known as the business corporation tax see Rhode Island General Laws Chapter 44-11.

Corporate income is taxed at a single rate of 7. Foreign Limited Liability Partnership LLP - RI. An annual minimum corporate tax of 400 applies to all business entities required to register to do business in Rhode Island.

Personal Income Tax A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island. Living up to its reputation as the Property Management. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. 11-0001 Form RI-1040ES - Estimated Individual Income. On August 3 2017 Rhode Island enacted affiliate and economic nexus with an alternative reporting requirement structure for those remote sellers that do not collect Rhode.

In the revised rules physical presence including presence of holding property agents representatives or independent contractors who sell goods or services within Rhode Island. The purpose of this regulation is to implement Rhode Island General Laws RIGL Sections 44-11-4 and 44-11-41. The Nexus Property Management franchise located in downtown Pawtucket RI has been locally owned and operated since 2013.

As of 2018 S corporations are subject. Like most other states in the Northeast Rhode Island has. RI-1040 can be eFiled or a paper copy can be filed via mail.

Form RI-1040 is the general income tax return for Rhode Island residents. Generally a business has nexus in Rhode Island when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

96 Apportionment Generally 97Combined Reporting Requirement for Tax Years Beginning on or After January 1 2015 98Single Sales Factor Apportionment and Market Based Sourcing. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. 85 Definitions 86 Nexus - Generally 87 Corporations Subject to Taxation - Generally 88 Combined Reporting Requirement for C-corporations and Combined Groups - Factor-Based.

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Tuesday 2018 Rhode Island Insightfulaccountant Com

State Corporate Tax Throwback Rules And Throwout Rules

Income Tax Nexus Withholding Implications Of Telecommuting Employees During Covid 19 Forvis

Klr Rhode Island Corporate Income Tax Changes

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

Tcja State Tax Impact Simekscott

Rhode Island To Tax Digital Goods And Exempt Tampons

Economic Nexus The New Normal Berdon Llp

Sales Taxes In The United States Wikiwand

State By State Guide To Economic Nexus Laws

State By State Guide To Economic Nexus Laws

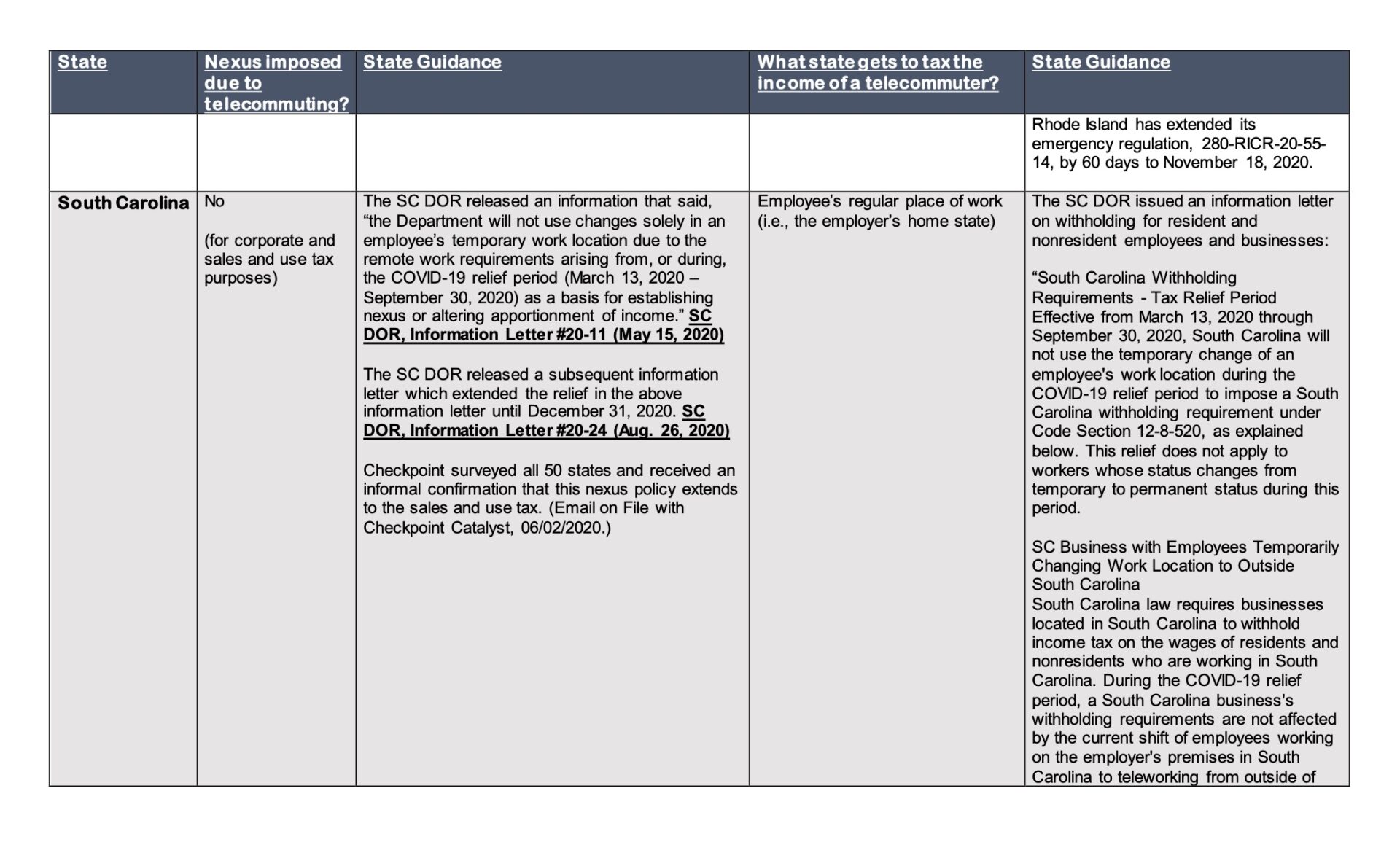

State Guidance On Whether Covid 19 Telecommuters Create Nexus Salazar Cpa

2021 State Income Tax Nexus For Telecommuters Wolters Kluwer